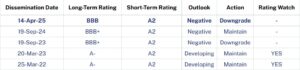

Rating History

Escorts Investment Bank Limited (“Escorts Bank” or “the Bank”) is a subsidiary of Bahria Town (Pvt) Limited, a privately

owned real estate development company that owns, develops, and manages properties across Pakistan. Escorts Bank has adopted

a cautious approach to avoid non-performing loans and the revenue gathers support from profit on financing, followed by the

other income. Relevant to the Bank’s business model, house finance is a prominent contributor to the Bank’s total portfolio. A

major proportion of revenue comes from mortgage and microfinance portfolios. On a net level, the Bank continues to incur

losses due to higher non-markup expenses; however, the quantum of losses has reduced. Earlier, the write-off of tax refunds

(pertaining to the takeover period) and re-assessment of deferred tax assets; owing to a change in business plan rendered the

Bank short of equity as required to maintain under NBFC Regulations. Escorts Bank’s capital structure mainly comprises equity,

with a stagnant debt-to-equity ratio. Escorts Bank remains non-compliant with the Minimum Capital Requirement of PKR

750mln. In the form of equity injection, sponsor support remains vital for the ratings. Going forward, development of a

comprehensive business plan, with clear modalities and materialization, remains critical.

Going forward, the sponsors plan to bring in a new partner, who is expected to inject fresh equity into the Bank. With this new injection, the Bank’s capital is expected to reach a size that would enable them to obtain a full-fledged IFS license which is the target and being envisaged by the new management.